1. Introduction: Boric Acid’s Strategic Role in Asia’s Growth

Boric acid has long been a critical inorganic chemical supporting construction, manufacturing, and materials engineering. In Asia, its importance has increased as infrastructure investment and industrial output continue to expand across emerging and developed economies. These structural drivers provide a stable foundation for long-term demand.

Unlike short-cycle specialty chemicals, boric acid is deeply embedded in essential industrial processes such as glass strengthening, ceramic formulation, and insulation material production. This embedded usage pattern reduces demand volatility and supports consistent procurement volumes. As a result, boric acid remains a strategic input rather than a discretionary material.

According to global chemical market analyses published by IMARC Group, Asia Pacific represents one of the fastest-growing consumption regions for boric acid due to its concentration of infrastructure and manufacturing activities. These findings highlight Asia’s role as a demand anchor in the global boric acid market.

For buyers sourcing industrial grades such as Boric Acid 99% Granular Chile, understanding Asia’s macroeconomic growth drivers is essential for aligning long-term sourcing strategies.

2. Asia Boric Acid Market Overview and Forecast to 2026

The boric acid market in Asia is expected to maintain a stable growth trajectory through 2026, supported by ongoing urbanization and industrialization. Market expansion is driven less by speculative demand and more by structural consumption across infrastructure-related sectors. This creates a predictable demand environment for suppliers and buyers alike.

Regional consumption is concentrated in construction materials, ceramics, fiberglass, and chemical manufacturing. These industries are less sensitive to short-term economic cycles, particularly in countries with long-term infrastructure plans. As a result, boric acid demand exhibits resilience even during broader market fluctuations.

Market research from Data Bridge Market Research indicates that global boric acid demand growth is increasingly led by Asia, where capacity additions and infrastructure spending outpace other regions. This reinforces Asia’s central role in shaping global supply-demand dynamics.

From a sourcing perspective, buyers working with internationally traded grades such as Boric Acid 99% Granular Turkey benefit from predictable demand patterns that support stable procurement planning.

3. Infrastructure Development Driving Boric Acid Consumption

Infrastructure development remains one of the strongest demand drivers for boric acid in Asia. Large-scale investments in transportation networks, commercial buildings, and energy-efficient construction materials rely heavily on boric-acid-based glass and insulation products. These applications create sustained baseline demand.

Boric acid is a key component in borosilicate glass, fiberglass insulation, and specialty ceramics used in infrastructure projects. Its role in enhancing thermal resistance and mechanical strength makes it indispensable in modern construction standards. As infrastructure specifications evolve, boric acid usage remains firmly embedded.

Scientific and engineering studies indexed by SpringerLink emphasize the importance of boron compounds in improving glass durability and performance. These technical advantages explain why infrastructure-led demand for boric acid continues to grow alongside stricter building codes.

Industrial buyers supplying infrastructure-linked sectors often source globally traded materials such as Boric Acid 99% Granular Bolivia to meet consistent volume and quality requirements.

4. Industrial Manufacturing and Chemical Processing Demand

Beyond infrastructure, industrial manufacturing plays a central role in sustaining boric acid consumption across Asia. The chemical manufacturing sector uses boric acid as a precursor, buffering agent, and performance enhancer in multiple formulations. These applications support stable off-take from chemical processors.

Asia’s expanding base of electronics, ceramics, and metal processing industries further reinforces demand. Boric acid’s ability to improve heat resistance and chemical stability makes it valuable in high-temperature and precision manufacturing environments. These functional benefits ensure continued specification.

According to chemical processing research published by Elsevier, boric acid remains a preferred additive in industrial formulations due to its cost-effectiveness and performance reliability. Such findings support long-term demand expectations in manufacturing-heavy economies.

Suppliers offering standardized grades such as Boric Acid 99% Granular Peru are well positioned to serve Asia’s industrial manufacturing customers.

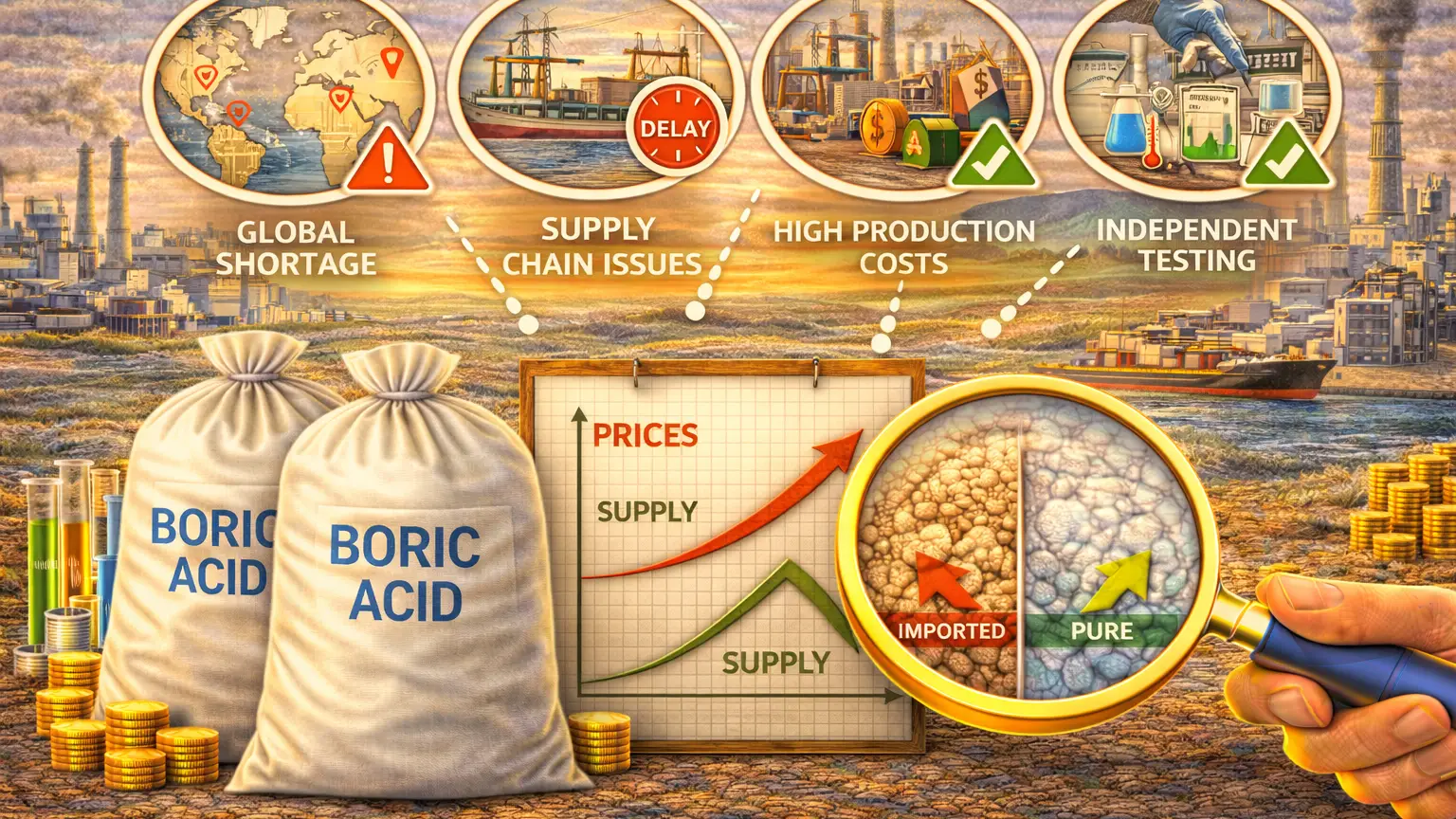

5. Global Supply Sources and Trade Flows into Asia

Asia’s boric acid demand is largely met through imports from established producing regions. Countries such as Chile, Turkey, Bolivia, and Peru play a significant role in supplying high-purity boric acid to Asian markets. This global sourcing structure underpins supply continuity.

Trade flows are supported by long-term contracts and established logistics routes that link producers to Asian consumers. These arrangements reduce supply risk and help stabilize pricing despite fluctuations in upstream mining operations. As a result, Asia benefits from diversified sourcing.

Market intelligence published by UnivDatos highlights that Asia’s boric acid trade volumes are expected to grow steadily toward 2026, driven by application-led demand rather than speculative stockpiling. This trade-driven growth supports predictable procurement cycles.

For buyers, access to consolidated technical documentation through resources like the Download Center simplifies supplier evaluation and regulatory compliance across international supply chains.

6. Procurement Considerations for Industrial Boric Acid Buyers

Industrial buyers sourcing boric acid in Asia must balance quality specifications, origin, and supply reliability. Granular purity, moisture content, and packaging standards are key considerations, particularly for infrastructure and manufacturing applications. These factors influence both performance and handling efficiency.

Long-term procurement strategies increasingly emphasize supplier transparency and documentation. Buyers seek partners who can provide consistent product quality alongside technical support and regulatory information. This approach reduces operational risk and supports audit requirements.

According to procurement best practices discussed in Wiley’s industrial sourcing publications, centralized access to product data improves decision-making and supplier benchmarking. This trend is particularly relevant for globally sourced inorganic chemicals like boric acid.

Engaging directly with suppliers through channels such as Contact Us enables customized sourcing discussions aligned with application needs and regional market conditions.

7. Conclusion: Outlook for Boric Acid Demand Beyond 2026

Asia’s boric acid market outlook through 2026 remains firmly supported by infrastructure development and industrial manufacturing growth. These demand drivers provide structural stability that extends beyond short-term economic cycles. As a result, boric acid continues to be a strategic industrial chemical.

Insights from IMARC Group, Data Bridge Market Research, and regional B2B analysis confirm that Asia will remain a primary growth engine for global boric acid demand. This convergence of data underscores the importance of long-term supply planning for buyers and suppliers.

Industrial buyers can align sourcing strategies by referencing globally traded grades such as Boric Acid 99% Granular Chile, Boric Acid 99% Granular Turkey, Boric Acid 99% Granular Bolivia, and Boric Acid 99% Granular Peru. Additional market context is available through Application-Driven Demand for Boric Acid in Asia 2026, IMARC Group, and Data Bridge Market Research.

For companies planning future procurement or distribution strategies, engaging with Tradeasia through the Contact Us channel enables tailored discussions aligned with Asia’s evolving boric acid market.

Leave a Comment