Introduction

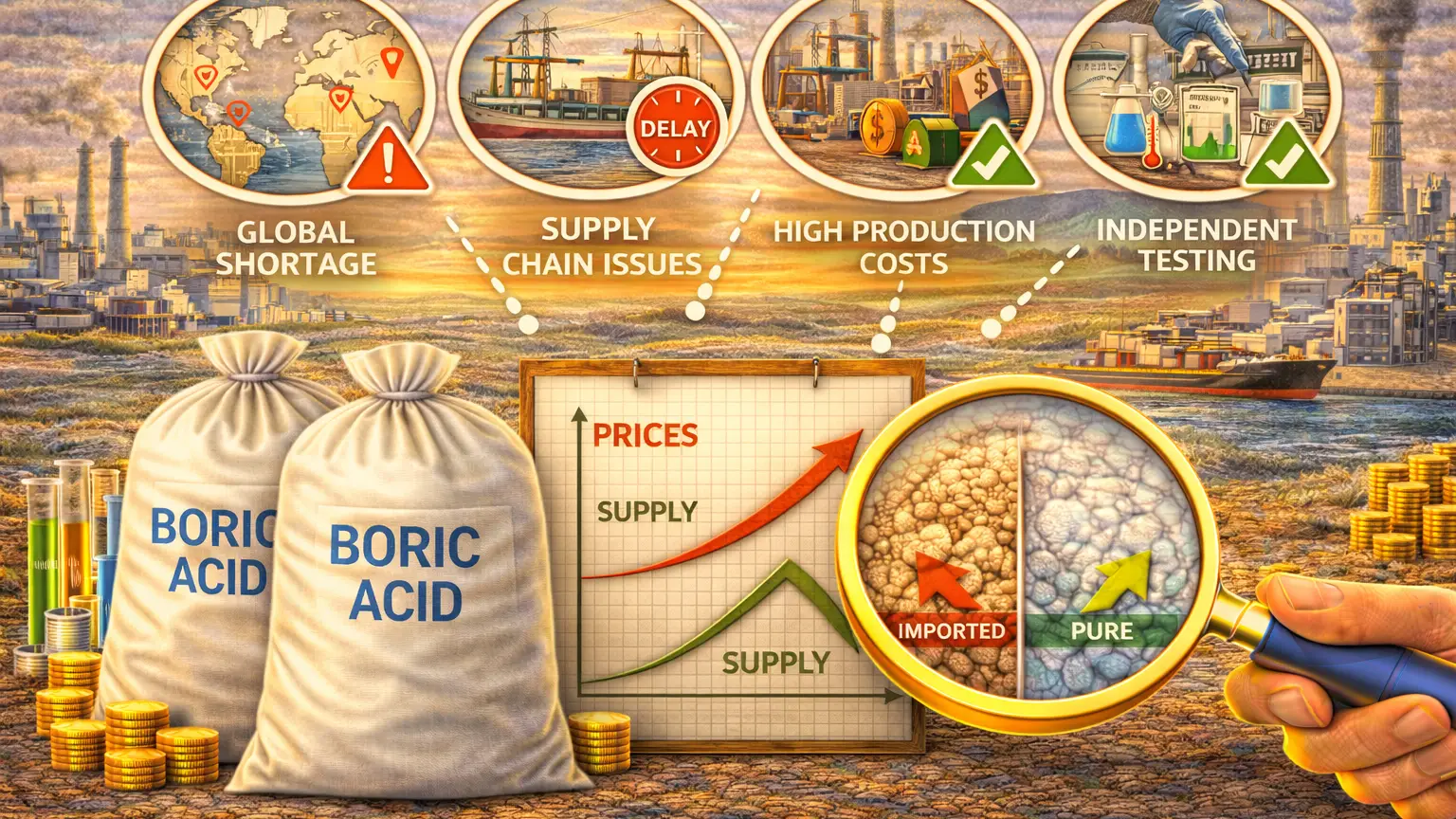

The American industrial landscape is navigating a period of significant volatility in chemical pricing, and boric acid is no exception. This versatile, inorganic compound, a cornerstone in sectors from agriculture to nuclear power, has seen its market value fluctuate under a complex web of pressures in recent months. For procurement managers, plant operators, and business leaders, understanding these price drivers is not merely an academic exercise—it is a critical component of budgeting, supply chain resilience, and competitive strategy. This article delves beyond surface-level explanations to uncover the multifaceted forces truly shaping boric acid prices in the U.S. market this year.

While general inflation and logistical challenges contribute, the story is deeply rooted in specific geopolitical tensions, concentrated raw material sources, and surging demand from high-tech industries. Companies that rely on a steady, cost-effective supply of boric acid must look to partners who offer not just product, but market intelligence and supply chain stability. This analysis will provide a comprehensive view of the market, culminating in actionable insights for securing this essential chemical.

The Global Supply Chain: A Fragile Foundation

The journey of boric acid to an American factory floor often begins thousands of miles away, making it inherently vulnerable to global disruptions. The majority of the world's boron reserves, from which boric acid is derived, are concentrated in just two countries: Turkey and the United States (primarily in California). This geographical concentration creates a supply chain bottleneck. Any political instability, trade policy shift, or environmental regulation in these regions sends immediate shockwaves through the global market. For instance, Turkey's strategic position and its control over a significant portion of global refined boron output give it substantial pricing power, directly impacting import costs for American buyers supplementing domestic production.

Furthermore, maritime logistics remain a persistent pressure point. Although freight rates have stabilized from their pandemic peaks, port congestions, labor disputes, and rerouting due to geopolitical conflicts (like tensions in the Red Sea) continue to inject uncertainty and cost into the transportation leg. The "just-in-time" inventory model, once a standard, has proven risky. Many American manufacturers are now building larger safety stocks of critical chemicals like boric acid, which in itself creates short-term demand spikes that further strain supply and elevate spot prices. This shift towards strategic inventory holding is a key, often overlooked, driver of current market tightness.

Raw Material Dynamics: The Boron Bottleneck

At its core, the price of boric acid is tethered to the availability and cost of its parent material: boron minerals, chiefly colemanite and ulexite. Mining these minerals is capital-intensive and subject to stringent environmental permitting, especially in California. Operational challenges, such as water usage restrictions in drought-prone regions or unexpected mine closures for maintenance, can swiftly reduce the raw material feed for boric acid production. When mine output dips, the entire downstream production chain feels the squeeze, leading to allocation programs and premium pricing for available material.

Energy costs are another inextricable link in this chain. The processing of boron ores into refined boric acid is an energy-intensive operation involving crushing, dissolving, and crystallization. The volatility of natural gas and electricity prices in the U.S. directly translates into fluctuating production costs for domestic manufacturers. These costs are inevitably passed down the supply chain. Therefore, the price at the factory gate for boric acid is not just a reflection of the mineral's value, but also a ledger of the energy consumed to transform it into a usable industrial product.

Industrial Demand: Key Sectors Exerting Pressure

Demand-side pressures are equally potent in the current pricing equation. Traditionally, the largest consumers of boric acid have been the fiberglass and insulation industries, where it is used as a flux and stabilizer. The sustained push for energy-efficient buildings and infrastructure in America continues to fuel steady demand from this sector. However, newer, high-growth industries are now competing for the same supply. The electronics sector, for example, relies on high-purity boric acid in the manufacture of LCD screens and semiconductors, where its properties are difficult to substitute.

Perhaps the most significant emerging demand driver is the energy transition. Boric acid serves as a neutron absorber in nuclear power plants, both existing pressurized water reactors and in the next-generation small modular reactor (SMR) designs gaining traction. As the U.S. re-emphasizes nuclear power in its carbon-neutrality goals, long-term procurement contracts from utility companies are locking in substantial volumes of supply. This strategic stockpiling for energy security creates a competitive landscape where industrial users must be increasingly agile and well-connected to reliable suppliers to secure their necessary allocations.

Boric Acid: Product Specifications and Critical Applications

Understanding the product itself is crucial to understanding its value. Boric acid (H3BO3) is not a commodity with a single grade; its specifications dictate its price and suitability. Industrial-grade boric acid, typically with a purity of 99.5% or higher, is the workhorse for most applications. It appears as a white, odorless powder or crystalline material that is soluble in water. Key specifications buyers must verify include assay (purity), sulfate (SO4) content, chloride (Cl) content, and heavy metal limits (like Iron, Fe). For instance, in fiberglass production, low iron content is critical to maintain optical clarity and strength in the final glass product.

The applications of boric acid are remarkably diverse, which underpins its market stability. Beyond fiberglass and nuclear power, it acts as a flame retardant in cellulose insulation, wood treatments, and plastics. In agriculture, it is an essential micronutrient (boron) in fertilizers, correcting soil deficiencies that affect crop yield and quality. It serves as a mild antiseptic in personal care products, a preservative in natural adhesives, and a precursor for other boron compounds. This wide application base means that a price shock in one sector (e.g., a boom in construction) can ripple out to affect availability and cost for users in unrelated fields like agriculture or pharmaceuticals, highlighting the interconnectedness of the market.

Geopolitical and Regulatory Influences

The boric acid market does not operate in a political vacuum. Trade policies and international relations have a direct and immediate impact. Tariffs, anti-dumping duties, or export restrictions imposed by or on key producing nations can alter trade flows overnight. For American importers, reliance on Turkish boric acid means exposure to the foreign policy dynamics between the U.S., Turkey, and the broader region. Any sanction or trade dispute can limit access or impose cost penalties, forcing a scramble for alternative (and often more expensive) sources.

On the domestic front, environmental, health, and safety regulations continually evolve. The EPA's Toxic Substances Control Act (TSCA) and similar state-level regulations govern the manufacture, import, and use of chemicals. While boric acid is generally regarded as having low toxicity, any new regulatory findings or changes in classification can necessitate process modifications, additional safety equipment, or altered labeling for handlers. These compliance costs are factored into the final price. Furthermore, stricter environmental controls on mining and chemical processing in the U.S. can limit production capacity expansion, keeping supply tight even in the face of growing demand.

Strategic Sourcing: Mitigating Price Volatility

In such a turbulent market, a proactive sourcing strategy is the best defense against cost overruns and supply disruptions. The first pillar of this strategy is supplier diversification. Relying on a single source, whether domestic or international, is a significant risk. Partnering with a established, global chemical supplier like Chemtradeasia.com provides access to a networked supply chain. Such suppliers often have multiple qualified sources and the logistical expertise to navigate international trade, offering buyers a buffer against regional shortages.

The second pillar is moving beyond transactional purchases to strategic partnerships. Engaging with a supplier that provides market intelligence—forecasts on boric acid prices, alerts on geopolitical developments, and insights into demand trends—allows procurement teams to make informed decisions. Consider negotiating flexible contracts that combine fixed-price agreements for baseline volumes with options for additional spot market purchases. For consistent, high-volume users, exploring direct partnerships with producers or major distributors can secure preferential status. Ultimately, the goal is to transform boric acid procurement from a cost center vulnerable to market whims into a stabilized, predictable component of operations.

Conclusion

The trajectory of boric acid prices in America this year is being charted by a confluence of deep-seated factors: a tightly held raw material base, robust and diversifying demand, a fragile global logistics network, and an unpredictable geopolitical climate. While some cost pressures, like energy, may ease, structural issues like supply concentration and strategic demand from the nuclear and tech sectors are likely to maintain a firm price floor. For American businesses, passive price-taking is no longer a viable option.

Success will belong to those who deepen their market understanding, strengthen their supplier relationships, and build agility into their supply chains. By partnering with knowledgeable distributors who can provide not just quality boric acid but also strategic insight, companies can navigate the volatility. In this complex market, the most reliable price driver you can control is your own sourcing strategy. Investing in that strategy today is the surest way to ensure a stable, cost-effective supply of this indispensable industrial chemical tomorrow.

Leave a Comment